Reverse Mortgage Loan for a better retirement

A Reverse Mortgage Loan for Americans for a Better Retirement :

Reverse Mortgage Loan is solely dedicated

to helping older Americans use their home equity for a better retirement

For all that a home gives us-things like safety, stability, security and a place to create and store our memories-one gift we tend to overlook is the future it can also give us.

You can begin to unlock that future by using some of

your home's equity, which has likely increased over time, becoming your most

valuable asset.

There are, of course, different ways to access your

home equity, but if you're 62 or older, you may want to consider a reverse

mortgage. Not only can you use it to access tax-free cash, but you don't have

to repay your loan until you leave the home.

This way, you'll have the financial freedom and

flexibility to design the retirement you want, whether that's paying off bills,

fixing up the house, traveling or investing more, or helping out your children.

Use this helpful guide to bring greater clarity and

certainty to your future, with the open invitation to call American Advisors

Group anytime about whether a reverse mortgage-or another of their home equity

solutions-can help you achieve a better retirement.

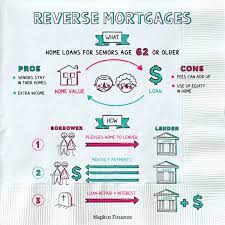

What Is a Reverse Mortgage Loan?

Unlike a traditional home equity loan, such as an FHA

or refinance loan that you begin paying back soon after your loan closes, a

reverse mortgage doesn't have to be repaid until you leave your home*. In

addition to having no monthly mortgage payments, you will receive tax-free

proceeds from your reverse mortgage, and you can designate how you want to

receive them. Reverse mortgages were specifically designed to help those 62 and

older supplement their retirement.

The most widely available reverse mortgage loan is a

Home Equity Conversion Mortgage (HECM), insured by the Federal Housing

Administration (FHA). For higher-value homes that exceed the limit set by the

FHA, borrowers may be better suited with a non-HECM loan, also known as a jumbo

or proprietary reverse mortgage.

NOTE:

*You must continue to maintain your

property, pay property taxes and homeowners insurance, and otherwise comply with

all loan terms.

More than 1 million homeowners 62 and over have used a

HECM reverse mortgage to age in place.

(U.S. Dept. of Housing and Urban

Development, HECM Endorsement Summary Report, 2017)

How Do You Qualify For A Reverse Mortgage ?

To be eligible for a reverse mortgage, you must:

1.

Be

62 years or older (a non-borrowing spouse may be under age 62),

2.

Own

and live in your home as your primary residence,

2.

Undergo

a financial assessment to ensure a reverse mortgage can serve you as a sustainable,

long-term retirement solution,

4.

Receive

counseling by an independent, HUD-approved third-party to confirm you

understand your obligations and responsibilities with a reverse mortgage,

5.

Maintain

the property and continue paying property taxes, homeowners insurance,

homeowner association and any other applicable fees.

Does Your Property Qualify?

For HECMs

1.

Single-family

homes or 2-4 unit homes (You must occupy one of the units)

2.

HUD-approved

condominiums*

3.

Manufactured

homes that meet FHA requirements

How Much Money Could You Qualify For?

The size of your loan amount is based on three primary

factors.

1. Your Age:

The age of the youngest borrower or eligible

non-borrowing spouse-the older you are, the more funds may be available.

2. Your Home's Value:

The higher your home appraises at, and the more equity

you have in your home, may make more funds available .

3. Current Interest Rate:

Fixed and adjustable rate options are available the

lower the interest rate, the more funds may be available.

How Can You Access Your Funds?

Choose the payout plan that works best for you:

Term:

Receive monthly payouts for a fixed term,

Receive monthly payouts for life,

Lump sum payout:

Maximize your cash payout,

Growing line of credit:

Use as needed, interest charged only on the portion

you access.

*Available with Tenure-Based or Modified

Tenure plans, so long as Borrower does not default on the loan Borrower must

maintain home as principal residence, pay all taxes, insurance, maintain the

home, and comply with all other loan terms. With Modified Tenure plans, lender

will set aside a specific amount of money for a line of credit.

Modified plan:

Combine options for even greater control; an reverse mortgage professional can show you how.

"The entire process was very smooth

and concise. It was just the boost in cash flow we needed to live a good life

without dipping into our stocks and bonds. This was the perfect solution for us".

Your Reverse Mortgage Responsibilities :

Although a reverse mortgage can eliminate monthly

mortgage payments (principal and interest), you must continue to maintain your

property, pay all property taxes, homeowners insurance and comply with your

loan terms, as you would with any mortgage. To ensure that you can meet these

ongoing financial responsibilities you can establish a set-aside account that

can be financed into your reverse mortgage to limit your initial, out-of-pocket

expenses.

If you don't comply with your loan terms, however,

your home could go into default, which could lead to foreclosure.

It's also important to note that while you can sell

your home and pay off your loan balance any time without a prepayment penalty,

reverse mortgages make more sense financially the longer you plan to stay in

your home, as you're spreading your initial loan costs out over a longer

period.

Receiving funds from a reverse mortgage will not

affect your Social Security or Medicare. A reverse mortgage, however, could

impact Medicaid or Supplemental Security Income (SSI), so please speak with

your accountant or tax advisor for more information.

Advantages & Strategies of Reverse Mortgage:

Reverse Mortgage Advantages:

With a reverse mortgage, you not only remain the owner

of the home, but you can live in your home for as long as you want, with no

monthly mortgage payments*

a.

The

home equity you access is tax free (Consult your tax advisor),

b.

Use

your proceeds almost any way you wish (See Strategies),

c.

HECMS

are federally insured, meaning if your lender defaults, you still receive your

payments,

d.

Because

reverse mortgages are non-recourse loans, neither you nor your heirs will ever

owe more than your home is worth.

Reverse Mortgage Strategies:

The ways people are responsibly using their reverse

mortgages for a better retirement are virtually unlimited.

1)

Pay

off my existing mortgage to increase cash flow.

Paying off your current mortgage is a reverse mortgage

requirement. By removing your monthly mortgage payments, your cash flow

increases*.

2)

Renovate

my home to make it safer and more enjoyable.

The right home improvements can also help maintain or

even increase the value of your home.

3)

Give

my retirement savings accounts more time to grow.

By tapping home equity and leaving your investment

accounts intact, your assets can continue to grow through the magic of

compounding interest.

4)

Delay

taking my Social Security for larger payouts later.

Social Security benefits increase by a certain

percentage each year if you delay your retirement beyond full retirement age.

That's an effective savings plan.

5)

Build

a stronger safety net.

The best defense against unexpected expenses, such as

medical emergencies, sudden market downturns and other life events, is to

ensure you have financial resources standing by to deal with them.

6)

Gain

greater peace of mind for my long-term healthcare needs.

By creating a reverse mortgage line of credit, which

grows over time, you can have money for your care when you need it.

7)

Purchase

another home that will better fit my needs.

Instead of using all cash, put down only a portion of

the purchase price (from your previous home's sale or from other savings and

assets) and use a HECM to cover the rest, leaving you with no future monthly

mortgage payments".

*You must continue to maintain your

property, pay property taxes and homeowners insurance, and otherwise comply

with all loan terms.

8)

Protect

my portfolio in a down market.

Instead of being forced to sell an investment in a

down market, you could wait for the market to rebound by using proceeds

provided by a reverse mortgage to make up any shortfall.

9)

Create

a lifetime income stream for my family and me.

A reverse mortgage gives you multiple payment options,

including monthly disbursements for life as long as you live in your home**.

10) Pay off other debt, like high-interest

credit cards.

Using a reverse

mortgage to pay off credit cards or other high-interest debt may prove a sound

financial strategy. What a reverse mortgage shouldn't be used for, is an excuse

to overspend or avoid addressing what caused the debt in the first place.

**Available with Tenure-Based or Modified

Tenure plans, so long as Borrower does not default on the loan. Borrower must

maintain home as principal residence, pay all taxes, insurance, maintain the

home, and comply with all other loan terms. With Modified Tenure plans, lender

will set aside a specific amount of money for a line of credit

Stronger Safeguards and Protections :

Reverse mortgage loans come with many safeguards for

your financial protection.

Limited Fees

HECM origination fees are regulated by the U.S.

Department of Housing and Urban Development (HUD). HECM loan costs may vary

among creditors and loan types.

First-Year Withdrawal Cap

HUD established limits on the amount of money you can

access your first year to help you better balance your short and longer-term

financial needs.

Credit Line Growth

The unused portion of your credit line continues to

grow-giving you an incentive to responsibly access only the credit you need.

Financial Assessment

Before you can formally apply for a reverse mortgage,

you will undergo a financial assessment to determine whether a reverse mortgage

or another financial option can best serve you.

Counseling

You will receive counseling by an independent,

HUD-approved third-party to help you explore and address whether a reverse mortgage

or another alternative may offer you the best financiasolution for your needs

and goals.

No Pre-Payment Penalty

You can choose to repay your reverse mortgage anytime

without penalty.

Non-Recourse Loan

When repayment is due, neither you nor your heirs will

ever owe more than your home is worth.

FHA Mortgage Insurance: What You Need to Know

2. Should the lender default, you will continue to be

paid, regardless.

3. Should the balance of the loan be larger than the

value of the home when payment is due, the insurance fund covers the

difference.

The Truth About Some Popular Reverse Mortgage Myths :

Although simple in concept-converting a portion of

your home equity into cash while you continue to enjoy the comforts of living

in your own home* certain myths and misinformation have sprung up around

reverse mortgage loans. Here we address a handful of these common mistruths:

*You must continue to maintain your

property, pay property taxes and homeowners insurance, and otherwise comply

with all loan terms* .

The bank owns my home :

No. When taking out a reverse mortgage loan,

you retain title to the property. The lender puts a lien onto the title to

ensure repayment of the loan. This is the same for a reverse or a traditional

mortgage.

I cannot get a reverse mortgage loan if I have an

existing mortgage.

No. You just need sufficient home equity for

the loan to make sense.

I won't qualify because I don't have enough income.

No. You don't have to earn a certain amount

of money. Rather, you need to show you have the financial ability to pay your

ongoing property taxes, home insurance and other property-related expenses.

The lender receives whatever money remains after the

home is sold to pay off the reverse mortgage.

No. Any leftover funds go to the heirs or

the estate.

I will lose my house if I exhaust my loan funds.

No. You cannot lose your home as long as you

continue to comply with your loan terms, such as maintaining your home and

paying your property taxes and homeowners insurance.

I will be restricted on how I can use my reverse

mortgage proceeds.

No. You can use the proceeds for almost any

purpose.

I will be taxed on my loan amount.

No. Because a reverse mortgage is a loan,

your proceeds are not taxed. Consult your tax advisor for more information,

however, as tax laws can change.